Condo Insurance in and around Camp Springs

Welcome, condo unitowners of Camp Springs

Insure your condo with State Farm today

Your Stuff Needs Insurance—and So Does Your Condo Unit.

No matter your level of preparedness, the unexpected can happen. So be the condo owner who is prepared with quality insurance which may be able to help in the event of damage from theft, hail, or lightning.

Welcome, condo unitowners of Camp Springs

Insure your condo with State Farm today

Protect Your Home Sweet Home

You can rest assured with State Farm's Condo Unitowners Insurance knowing you are prepared for the unpredictable with dependable coverage that's right for you. State Farm agent Jonathan David Hancock can help you understand all the options, from a Personal Price Plan®, liability to replacement costs.

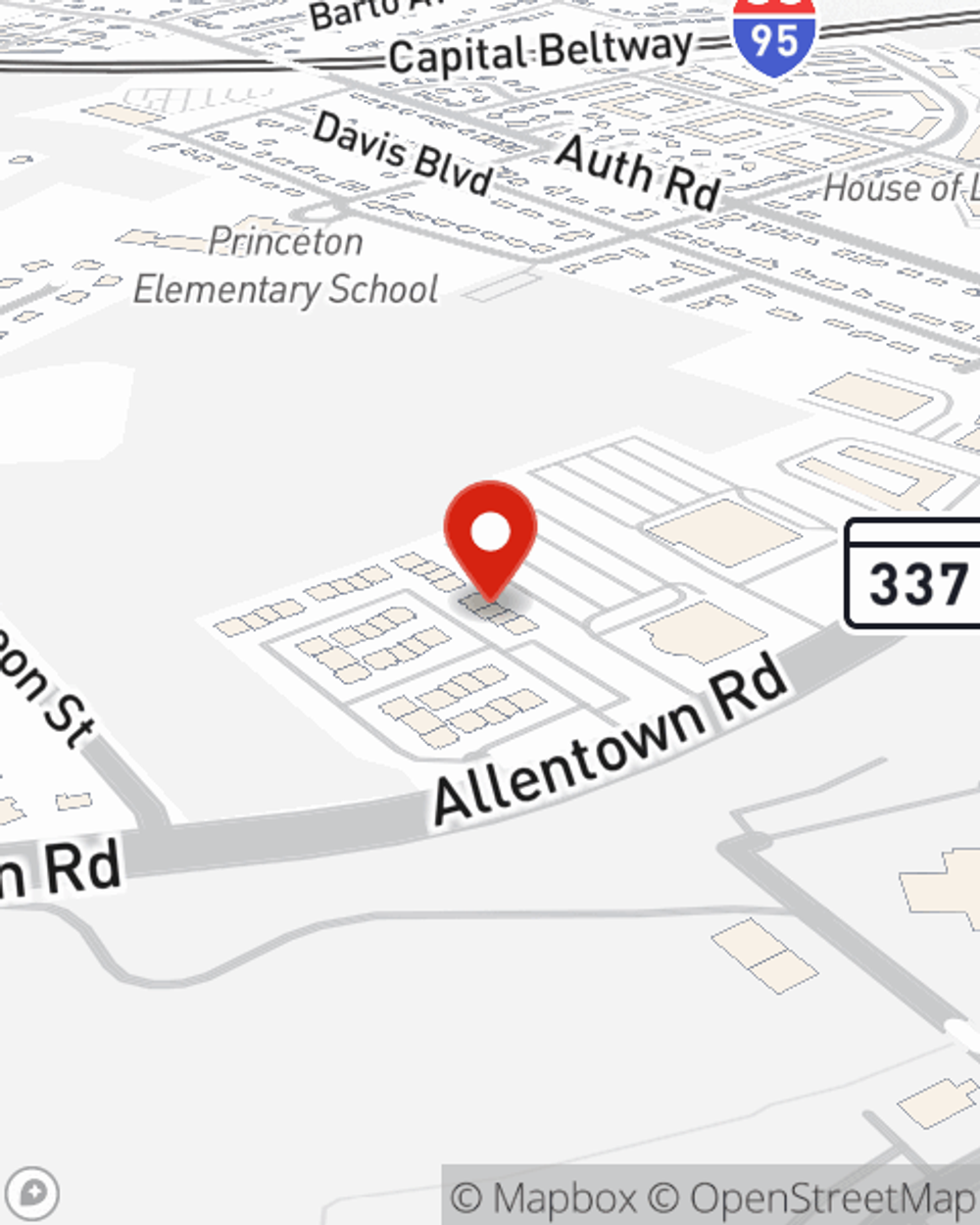

Great coverage like this is why Camp Springs condo unitowners choose State Farm insurance. State Farm Agent Jonathan David Hancock can help offer options for the level of coverage you have in mind. If troubles like wind and hail damage, drain backups or identity theft find you, Agent Jonathan David Hancock can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Jonathan David at (301) 868-6622 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Jonathan David Hancock

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.